Describe Types of Customers in Banking

We can therefore distinguish the different banks according to the functions they perform. Types of Bank 1 Central Bank The bank that acts as the central monetary authority of the country and serves the government is a central bank.

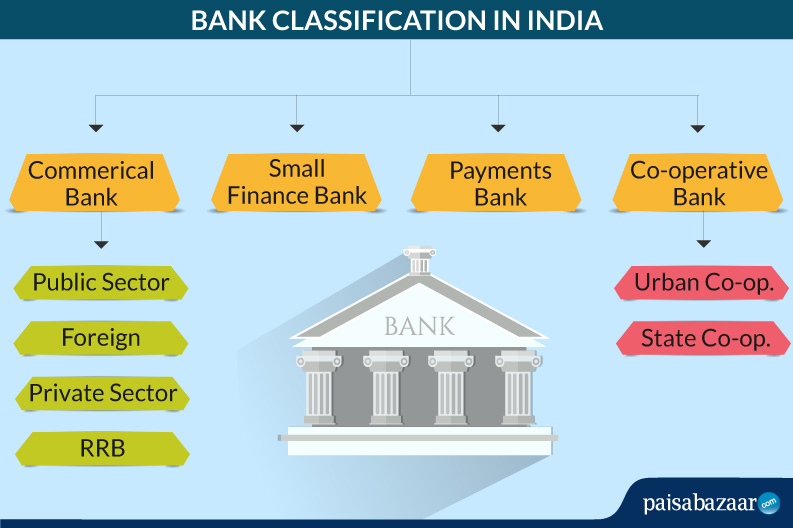

Banking In India Types Of Banks Banking Classification Paisabazaar

One of the important types of financial services provided by banks in modern days is online banking services to the customers so that they have easy access to their products and services.

. Discount customers are interested in your product only because you are offering it at a. Thus the relationship arising out of these two main activities is known as General. As technology advances and competition increases banks are offering different types of services to stay current and attract customers.

The relationship between a bank and its customers can be broadly categorized into General relationships and Special relationships. General Relationship If we look at Sec 5b of the Banking Regulation Act we would notice that the banks business is accepting deposits for lending. During the last three centuries different types of banks have developed.

Types of Bank deposit customers. The set of existing banks in the economic system conforms to the banking or banking system. Online banking is very convenient medium of banking which saves lot of time and money of the customer.

Joint Hindu Family JHF. They represent no more than 20 of your customer base but make up more than 50 of your sales. This is an important topic for the IAS Exam.

Sure there are a lot of different personas and behaviors among customers but we can simplify them into three categories. Even the older less technologically-engaged demographics that prefer in-person banking are eager to include other channels and expand their web or mobile-based interactions. Regional Rural Banks RRB Local Area Banks LAB Specialized Banks.

This is the most common form of incorporation. The first one is the cheap customers. These banks play the most important role in.

In this article aspirants will get information on the banking system in India its functions and the type of banks in India. 1 The Bully This type of difficult customer is quick to anger very aggressive highly critical impatient rude. TYPE OF CUSTOMERS On the basis of banking nature Customers can be classified as.

Attracts deposits of money from the public. They are given below. However the emergence of currency as a means of payment was the rapid evolution of the banking business which reached its formal establishment in the modern age and the Renaissance.

Private banks provide services exclusively to wealthy clients usually those with at least 1 million of net worth. These type of customers buy based on price. He is legally capable of entering into a valid contract.

An account can be opened by a person 4. There is no statutory definition of a customer but banks appear to rely upon to recognize a customer. For a person a person to be known as a customer of the bank there must be either a current account or any sort of deposit account like saving term deposit recurring deposit a loan account or some similar relation.

Loyal customers are the most important segment to appease and should be top-of-mind for any company. For this purpose the bank can open accounts for the public. Central banks manage the monetary system for a government.

The main functions of a central bank are. Lookers are the customers who are just browsing through your services and probably looking through your. Clubs Societies and Associations.

They help clients manage their wealth provide tax advice and set up trusts to avoid taxes when leaving money to descendants. In a majority of businesses there are three types of customers. Impulse customers are the best customers to upsell to and are the second most attractive segment.

These customers revisit the organization over times hence it is crucial to interact and keep in touch with them on a regular basis and invest much time and. This is similar to a C corporation but may only consist of up to 100 shareholders. Loyal Customers-These types of customers are less in numbers but promote more sales and profit as compared to other customers as these are the ones which are completely satisfied.

What are the Different Types of Customers. A banks job is to provide customers with financial services that help people better manage their lives. Describe three retail banking services appropriate to the needs of two contrasting customers Category Banking Credit Money Retail.

The corporation is taxed as a business entity and owners receive profits that are then also taxed individually. Types of Customers. Customers can be of following types.

They compare products and buy the lowest price. TYPES OF CUSTOMERS IN BANKING. Issue of notes Providing and conducting banking services tofor the Government Providing banking services to other banks.

Each type usually specializes in a particular kind of business. There are three main types of corporations. Joint stock companies Limited Liability Companies 5.

Todays customers operate across both digital and physical with 65 percent of customers interacting with their bank through multiple channels. Before the Purchase 1. Whether you are opening your first bank account or have managed a checking account for years it helps to know the different types of banking.

They do not have to buy a particular item at the top of their list but come into the store on a whim. They shop your store frequently but make their decisions based on the size of your markdowns. Non-resident individuals NRIs Various Types of NRI Accounts.

Types of Banking Systems.

Letters Of Credit How This Can Endorse Your Business Merchant Trade Guarantee Corporation Company Limited Types Of Lettering Lettering Credits

Types Of Bank Commercial Bank Business And Economics Investment Banking

What Is A Bank And Different Types Of Banks In 2022 Financial Management Bank Financial Retail Banking

Comments

Post a Comment